Baidoa, Somalia – In Baidoa’s dusty streets, where armed checkpoints, rising prices and chronic unemployment define daily existence, a recent government decree has generated new apprehension – citizens must now pay a personal income tax.

Southwest State authorities recently introduced the levy, applicable to all salaries, allowances and work-related earnings. Officials present it as a patriotic obligation and development initiative, encouraging compliance with the phrase, “Be a tax-paying citizen and help build your nation.”

For many Baidoa residents, this appeal falls on skeptical ears.

“I lack regular employment,” stated a young private-sector worker with inconsistent earnings, who requested anonymity due to security concerns.

“They impose taxes on those already facing hardship, yet our circumstances never improve,” added the worker.

Under the new framework, individuals earning $100 to $500 monthly will contribute 6%, while those earning $500 to $1,500 face a 12% rate. Higher brackets correspond to higher percentages. In a city with limited formal employment opportunities and where many families rely on daily labor, remittances or humanitarian assistance, even minor deductions carry significant weight.

As the provisional capital of Southwest State, Baidoa lies in a region long devastated by conflict. Routes connecting Bay and Bakool provinces have been severed by the al-Qaeda affiliated militant group Al-Shabaab for over ten years, restricting commerce and isolating communities. Businesses function under persistent threat, and journeys beyond urban centers frequently necessitate dangerous diversions or armed protection.

State representatives maintain the tax is essential to increase domestic revenue and diminish donor dependency, enabling the government to finance public services and security. “Revenue is fundamental to service provision,” one local defender of the policy explained.

However, detractors contend that taxation without visible improvements or transparency only intensifies public distrust. Civil servants and private employees alike doubt how funds will be allocated in an area where governmental structures remain underdeveloped.

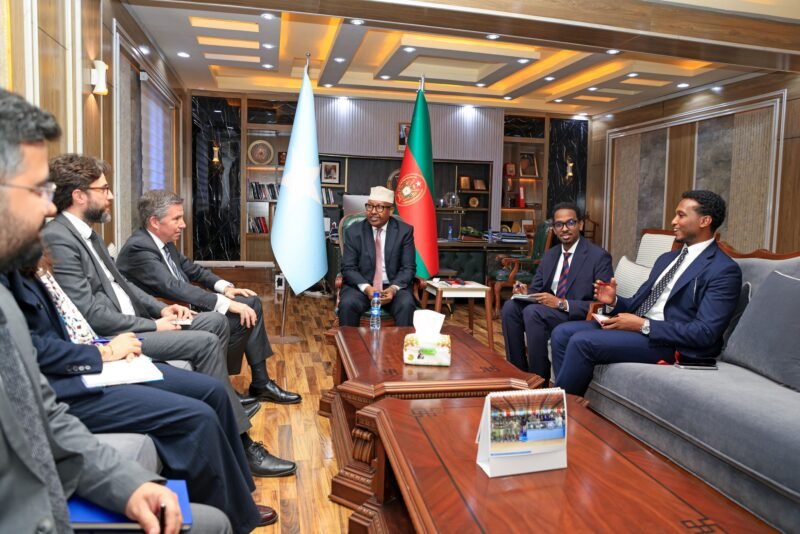

The administration of President Abdiaziz Hassan Mohamed Laftagareen has long faced allegations of corruption and favoritism. Rights groups report that his 2018 election was accompanied by Baidoa violence resulting in dozens of civilian deaths following confrontations with security forces. Opposition politicians claim his authority ended in December 2022, rendering his administration illegitimate, an assertion that the officials dismiss.

Some locals employ more critical expressions.

“Residents refer to him as the president who presides over a bloody seat,” remarked a regional analyst, indicating enduring resentment from the election-related violence.

The regional parliament, intended to provide supervisory function, is perceived by critics as ineffectual and controlled by the executive, intensifying apprehensions that the new tax might be improperly utilized. A local economist characterized the initiative as “a hardship on impoverished populations rather than a basis for advancement.”

“Southwest State has neither generated employment opportunities, restored transportation routes, nor enhanced security. Nevertheless, they are swift to tax the modest earnings of the population,” he observed.

Nevertheless, for governing officials, the decision represents an attempt, however contentious, to establish governmental authority and financial autonomy in an unstable area. For ordinary Baidoa inhabitants, it serves as another indication that survival entails increasing costs, despite persistent insecurity and unemployment.